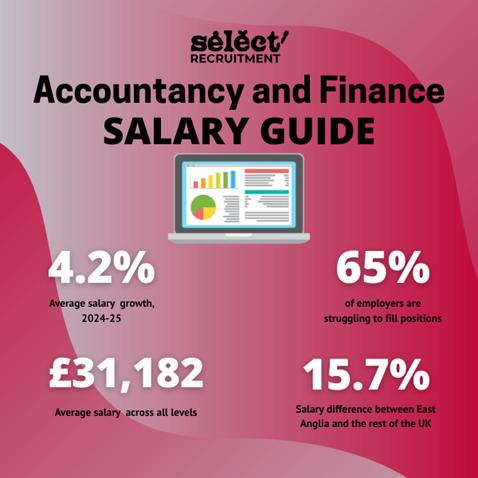

If you're looking for accountancy and finance salary information for 2025/26, here's what matters most: salaries are growing steadily, but where you work, what you specialise in, and which skills you possess can make a significant difference to your earning potential. The market remains tight, with most employers struggling to fill positions, which puts qualified professionals in a strong negotiating position.

As recruitment specialists working directly with both candidates and employers across East Anglia, we've compiled this guide to help you understand the factors shaping salaries in 2025 and what they mean for your career or hiring strategy.

The Current State of the Market

The accountancy and finance sector is experiencing steady growth, driven primarily by a persistent skills shortage. When two-thirds of employers struggle to fill positions, the natural result is upward pressure on salaries as companies compete for qualified candidates.

What makes this particularly interesting is that the shortage isn't evenly distributed. Certain roles and experience levels are far more challenging to fill than others, which explains why some positions are seeing significantly higher salary growth. Newly qualified accountants and those with two years post-qualification experience are particularly sought after, creating excellent opportunities for professionals at this career stage.

The market dynamics we're seeing aren't just about general demand. There's a specific skills gap emerging around modern finance technologies. Employers are actively seeking professionals who can work with cloud-based software and AI analytics tools, and they're willing to pay a premium for these capabilities. This shift reflects the broader digital transformation happening across the finance sector, where traditional accounting knowledge must now be paired with technological capability.

Understanding the Salary Landscape

The infographic above shows salary ranges across different roles and experience levels. What's worth noting beyond the specific figures is the pattern of growth across the profession.

Entry-level and junior positions are seeing steady, consistent growth that slightly outpaces inflation, reflecting ongoing demand for new talent entering the profession. However, the real story lies in the mid-career and specialist positions, where growth rates vary significantly based on the strategic value of the role.

Credit control stands out with exceptional growth, reflecting how businesses are prioritising cash flow management in the current economic climate. Companies understand that effective credit control directly impacts their financial health, and they're competing aggressively for professionals with proven expertise in this area.

Financial controllers are also seeing substantial increases, which makes sense given their role in maintaining financial integrity whilst supporting business growth. These positions require a blend of technical accounting knowledge, strategic thinking, and leadership capability that's challenging to find in the market.

At the senior leadership level, growth rates are more modest but the absolute figures remain substantial. Finance directors and CFOs command premium salaries that reflect not just their financial expertise but their strategic business acumen and ability to guide organisations through complex challenges.

Why Location Matters

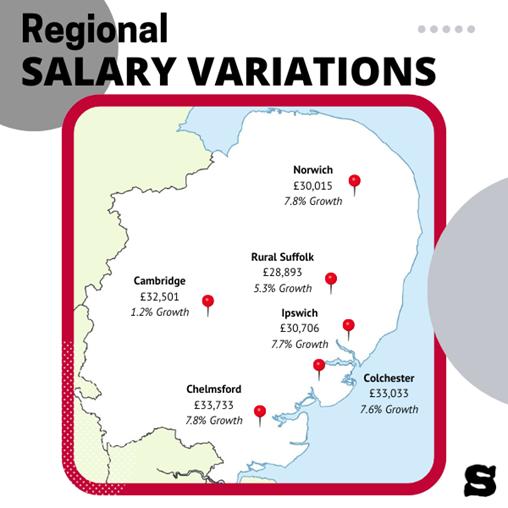

East Anglia shows considerable variation in salary levels across different areas, as illustrated in the regional map above. What drives these differences?

Norwich and Chelmsford are seeing particularly strong growth, reflecting their positions as regional business hubs with diverse economies. Both cities benefit from relatively lower costs of living compared to London whilst maintaining strong business communities that create genuine demand for finance professionals.

Colchester's higher average salary reflects its proximity to London and concentration of larger businesses. Many professionals working here benefit from London-adjacent compensation whilst enjoying lower living costs, creating an attractive proposition.

Cambridge presents an interesting case. Despite its strong economy and concentration of high-value businesses, salary growth is more restrained. This likely reflects already elevated salary levels reaching a natural ceiling, or perhaps increased competition from remote working arrangements that allow professionals to access Cambridge's quality of life whilst working for employers based elsewhere.

Rural areas naturally show lower average salaries, but this doesn't tell the whole story. Many rural employers offer benefits like better work-life balance, reduced commuting costs, and stronger community connections that can offset the salary differential. When evaluating opportunities, consider the total package rather than focusing solely on base salary.

The gap between East Anglia and national averages is gradually narrowing. Remote and hybrid working arrangements allow more professionals to live in the region whilst accessing higher-paying opportunities, and local businesses are competing more aggressively for talent.

Key Factors That Influence Your Earning Potential

Several market factors significantly affect what you can earn beyond your basic role and location.

The industry versus practice divide remains substantial, with industry roles commanding an almost 19% premium over practice positions. This gap reflects different business models and career structures. Industry roles often offer more predictable hours and involvement in strategic business decisions. Practice roles, whilst sometimes offering lower base salaries, frequently provide broader experience across multiple clients and clearer professional development pathways.

Technical skills now carry a measurable premium. The market insights show that professionals with expertise in cloud-based software and AI analytics tools can earn a lot more than those without these capabilities. If you're looking to increase your earning potential, investing time in learning platforms like Xero, QuickBooks Online, Power BI, or specialised financial analytics tools delivers tangible returns.

Hybrid working has become standard, with the vast majority of employers now offering flexible arrangements. Whilst this doesn't directly translate to higher salaries, it represents significant value in terms of work-life balance and reduced commuting costs. Some employers are using hybrid working as a retention tool, recognising that flexibility can be as valuable as salary increases for many professionals.

The skills gap affects different areas unevenly. Whilst most employers report experiencing skill shortages overall, credit management roles face particularly acute challenges. This explains the exceptional salary growth in these positions and creates opportunities for professionals who specialise in this area or who are willing to develop expertise in it.

What This Means for Job Seekers

Understanding these trends helps you make strategic decisions about your career development and salary negotiations.

Certain roles offer particularly strong growth potential right now. If you're considering where to focus your professional development, look at areas facing the most acute skills shortages. These represent not just higher current salaries but also strong future prospects as demand continues to outstrip supply.

When approaching salary negotiations, arm yourself with specific data about your role and location. The ranges shown in the infographics provide solid benchmarks, but remember that your specific experience, qualifications, and skills may justify positioning at the higher end of the range or even above it. In a market where most employers struggle to fill positions, you have more negotiating power than you might think.

Developing technical skills should be a priority regardless of your current role. The premium for cloud-based software and AI analytics expertise is substantial, and these skills are increasingly becoming requirements rather than nice-to-haves. Consider which platforms are most relevant to your sector or target employers, and invest time in gaining proficiency. Many providers offer free trials or low-cost training that can significantly boost your marketability.

If you're at the newly qualified or two-years post-qualified stage, you're in a particularly strong position. Employers value this career stage highly but struggle to fill these roles, creating excellent opportunities for negotiation and career progression. Don't undervalue your position in the market.

What This Means for Employers

These salary trends present both challenges and opportunities for organisations building finance teams.

Simply matching market rates may not be sufficient in a market where most employers struggle to fill positions. Consider the total package you're offering, including professional development opportunities, flexible working arrangements, and clear progression pathways. The data showing 90% of employers now offer hybrid working suggests that those who don't may be at a competitive disadvantage.

The cost of unfilled positions extends beyond immediate workload pressures. When existing team members must cover vacant roles, you risk burnout, reduced quality of work, and ultimately further resignations. This makes it worthwhile to pay competitively and invest in retention strategies. Sometimes offering slightly above-market salaries or enhanced benefits proves more cost-effective than extended vacancies or high turnover.

Think strategically about which roles you most need to fill and which skills are hardest to find. If you're struggling to recruit in high-demand areas, you may need to be more flexible on requirements, invest in training existing staff to move into these roles, or consider alternative working arrangements that might attract candidates who wouldn't consider traditional full-time office positions.

Consider the industry premium when competing for talent. If you're a practice-based firm, you'll need to articulate the other benefits you offer—broader experience, professional development, partnership pathways—to compete with industry salaries. Conversely, if you're an industry employer, your salary advantage can be a powerful recruitment tool.

Moving Forward with Confidence

The accountancy and finance sector going into 2026 presents genuine opportunities for both professionals and employers, though the market remains challenging due to persistent skills shortages. Salaries are growing at healthy rates, particularly in high-demand specialisms. Regional variations across East Anglia mean that location matters, though hybrid working is gradually reducing the importance of physical presence.

The premium placed on modern technical skills signals where the profession is heading. Those who adapt to these changes will find themselves well-positioned for both current opportunities and future growth.

Whether you're planning your next career move or looking to build a strong finance team, having accurate, current salary information is your starting point. At Select Recruitment, we work with professionals and employers across East Anglia every day, giving us real-time insights into what's happening in the market. If you'd like to discuss your specific situation, salary expectations, or recruitment needs in more detail, our team is here to help you make informed decisions.