Life as an Accountant: A Complete Career Guide

Accountants play a key role in business success, serving as both financial experts and strategic advisors. While numbers form the foundation of the profession, modern accounting requires a blend of analytical thinking, business acumen, and communication skills.

Duties often include:

Financial Reporting: Preparing accurate balance sheets, P&L statements, and statutory accounts.

Tax Compliance: Managing VAT returns, corporate tax filings, and ensuring adherence to HMRC regulations.

Strategic Planning: Providing data-driven insights for budgeting, forecasting, and business growth.

Auditing & Risk: Reviewing financial records to ensure accuracy and identifying potential financial risks.

Systems Management: Utilizing advanced accounting software and AI tools to automate routine processes.

The Daily Life of an Accountant

A typical day for an accountant begins with reviewing overnight financial system updates and addressing any urgent client emails. By mid-morning, you might be deep in complex spreadsheets, reconciling accounts or analysing cost variances for corporate clients. Client meetings often fill the afternoon hours, where you could find yourself explaining tax implications to small business owners or presenting financial forecasts to corporate executives.

The work demands both precision in numbers and strong communication skills. One hour you might be scrutinising journal entries for accounting errors, the next leading a video call with international stakeholders about compliance requirements. While independent work forms the backbone of the role, collaboration with colleagues in audit teams or tax departments is increasingly common in modern accounting practices.

The role's rhythm shifts with the calendar - tax season brings long hours and deadline pressures, while other periods allow for more strategic work like process improvement and financial planning.

Professional Qualifications and Career Entry

Starting a career in accounting typically follows several established paths. While a university degree in accounting or finance provides excellent groundwork, it's not the only route into the profession. Many successful accountants begin with degrees in different fields or enter through apprenticeships.

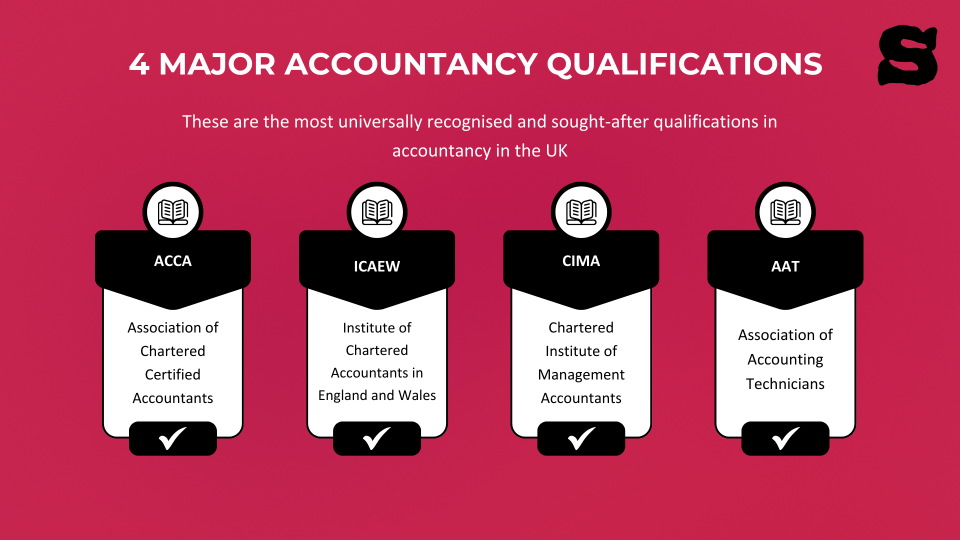

The main professional qualifications in the UK include:

ACCA (Association of Chartered Certified Accountants), offering broad expertise across accounting fields

ICAEW (Institute of Chartered Accountants in England and Wales), focusing on business and finance

CIMA (Chartered Institute of Management Accountants), specialising in business strategy and management

These qualifications typically take 3-4 years to complete while working, combining practical experience with theoretical knowledge. The AAT (Association of Accounting Technicians) qualification offers an excellent starting point, particularly for those entering the profession through non-traditional routes.

Skills for Success

Beyond numerical ability, successful accountants demonstrate several key attributes. Strong analytical skills help in interpreting complex financial data, while communication skills prove valuable when explaining financial concepts to non-specialists. Time management and attention to detail are particularly important during busy periods.

Technology plays an increasingly significant role in modern accounting. Proficiency with accounting software and digital tools has become essential, as has the ability to adapt to new technologies as they emerge. Like many sectors, AI is making waves in the world of accountancy. Check out our blog on AI in Accounting, and the new skills that are in demand in the sector.

Work Patterns and Life Balance

Most accountants work standard office hours, though patterns vary by specialisation and employer. Public practice roles might require longer hours during tax season (January to March), while industry positions often offer more consistent schedules. Many firms now provide flexible working arrangements, including remote work options.

Want to know more about the differences between working in practice and working in industry? Check out our article to learn which might be right for you.

Salary and Career Development

Financial rewards in accounting reflect experience, qualifications, and specialisation. Entry-level positions typically offer £23,000 - £28,000, while qualified accountants can expect £35,000 - £50,000. Senior positions and partnership roles can command £80,000 or more.

Career progression often follows a structured path from junior roles through to management positions, with opportunities to move into leadership roles in finance departments or establish independent practices.

Specialisation Paths and Their Impact

The accounting profession offers distinct specialisation options, each with unique career trajectories.

Management accountants partner with business leaders to drive strategic decisions, analysing costs and forecasting financial performance. Financial accountants focus on statutory reporting and regulatory compliance, often working with external stakeholders.

Tax specialists develop deep expertise in legislation and planning, commanding premium rates for their specialised knowledge. Forensic accountants combine investigative skills with financial expertise, working on cases involving fraud or disputes.

Each specialisation opens doors to different sectors and can significantly influence earning potential and career direction.

Make Your Next Move Count

Looking to start or advance your accounting career? At Select Recruitment, we partner with leading organisations across the UK to match talented professionals with rewarding opportunities. Our specialist Accountancy & Finance recruitment team understands the nuances of different accounting roles and can help guide your next career move. Contact us today for a chat.